For extra fraud protection, 3DS commonly known by its branded names such as Visa Secure, Mastercard Identity Check, and American Express SafeKey- require customers to complete an additional verification step with the card issuer when paying.

It is designed to authenticate the card user's identity to prevent payment fraud and reduce chargebacks at the same time.

Why is 3DS verification important?

Apart from significantly reducing fraudulent and high-risk payments, merchants who only accept 3DS verified payments are also protected from any fraudulent chargeback liability since 3DS shifts liability for fraudulent disputes onto the bank, as they have authorised the transaction.

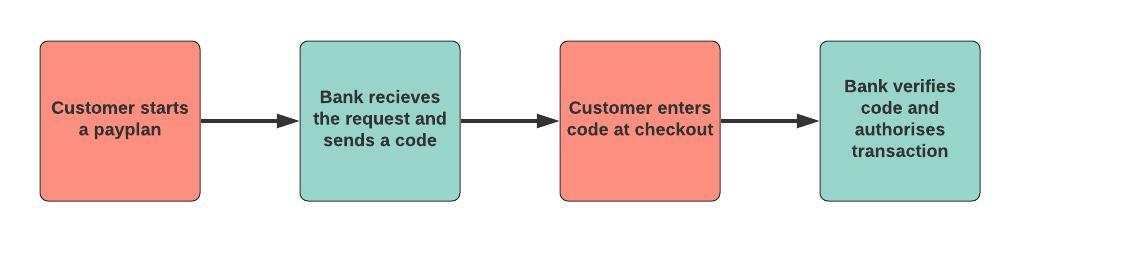

3DS Payment Flow

If you've shopped online for the past couple of years, chances are you're already familiar with 3DS. Typically, this is when the customer's bank, when triggered with a payment request sends a code to the number or account associated with the card. The customer is then required to enter the code to proceed and confirm authorisation of the associated transaction. In other words, only legitimate cardholders will be able to authenticate 3DS payments.